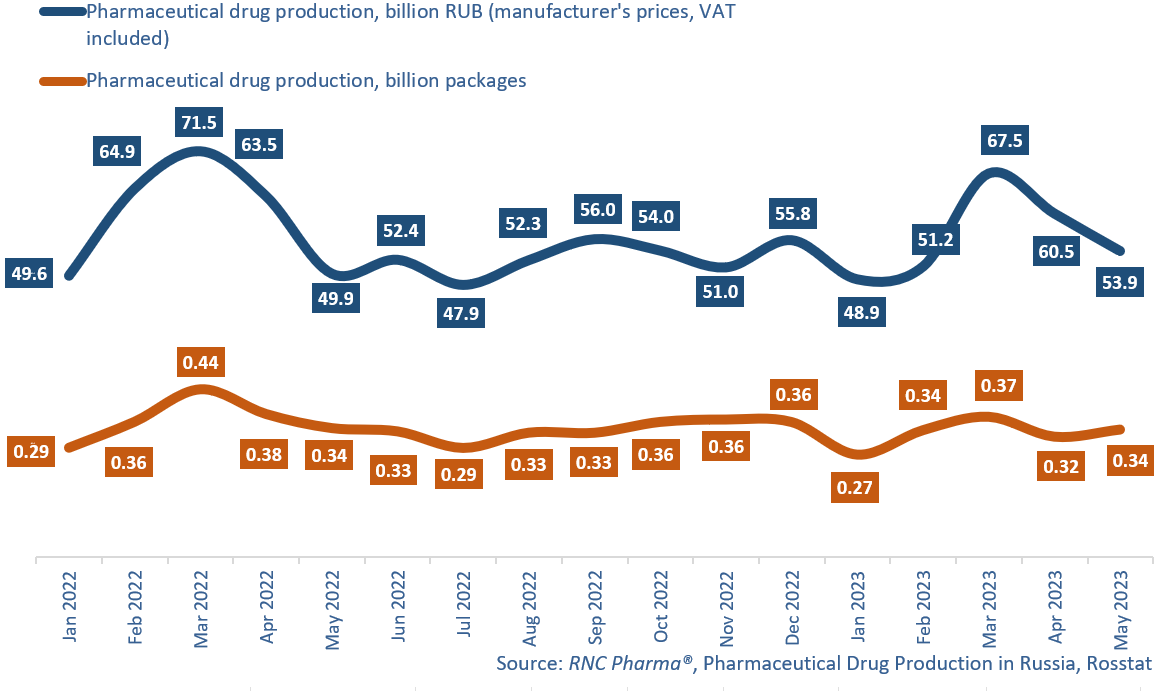

In January–May 2023, Russian manufacturers produced 282 billion rubles’ of pharmaceutical drugs (manufacturer’s prices, VAT included), down 5.8% from the same period in 2022. In physical terms, the production volume was 1.64 billion packages, down 9.7% from January–May 2022. If calculated in minimum dosage units (MDU), Russian manufacturers produced 32.2 billion MDUs, down 3.9% from January–May 2022.

The activity of Russian pharmaceutical producers in May 2023 is by far the best this year. Compared to May 2022, the production volume went up 8% in rubles, down 1% in packages, and up 2.6% in MDUs. While this is way better than in April 2023, April–May 2022 saw a drop in demand after the rush demand in March, and now the demand is clearly growing. The number of manufacturing companies in January–May 2023 was 390, up 23 from the same period in 2022. The number of INNs went up by nearly 50—to 1,309. At the same time, the number of SKUs was 7,830, up 546 from January–May 2022.

In physical terms, the production of prescription drugs fell 4.6% in packages and 1% in MDUs. Rx drugs were manufactured by 323 companies, up 25 from last year; more than half of them saw the production decrease. Among the top 20 companies with the largest production volume in physical terms, Novartis had the best growth rates—its production doubled. Sotahexal and Enalapril Hexal, manufactured at the company’s facilities in St. Petersburg, contributed to the growth rates the most. Novartis is followed by Gedeon Richter (+53%); the company increased the production of nearly the entire range of its prescription drugs, with Verospiron and Mydocalm contributing to the growth rates the best. Renewal came third (+49%); ITNW production of its Enalapril, Furosemide and Indapamide grew significantly.

As for OTC drugs, the production volume fell by as much as 13.7% in packages and by 7.3% in MDUs from January–May 2022. Only 73 manufacturers out of 173 saw a rise in demand. Among the largest manufacturers, Slavyanskaya Apteka increased its production 10.3 times against January–May 2022; its Naphthyzin contributed to the growth rates the most. Solopharm (+17%) came second, with Angidak and Gelangin helping the company’s growth rates the most. Cardiomagnyl and Levosin contributed to the growth rates of Stada (+16%).